SECURE YOUR SUCCESS

Getting out in front of risk has its rewards.

Achieving success is one thing. Securing it is another. At Marshall+Sterling, we’re driven to help you reach your business and lifestyle goals—and protect them as the future unfolds.

What We Do

Minimize risk.

Maximize success.

Marshall+Sterling is an independent agency focused on protecting clients with customized business insurance, employee benefits, personal insurance, equine insurance, and wealth management services.

Business Insurance

The world is full of uncertainty. Marshall+Sterling’s business insurance and risk management experts customize plans to help safeguard your business.

Employee Health and Benefits

Marshall+Sterling’s employee benefits experts design and implement compliant benefits programs to fit your business’s needs, culture, and strategic plan.

Personal Insurance

Whether for your home, auto, recreational vehicles, or life and health, we have solutions to protect you from whatever life throws your way.

Retirement and Wealth

Dedicated to simplifying the complexities of the financial world and supporting you in achieving and protecting what matters most.

Equine Insurance

Our Equine Division specializes in personalized plans that encompass a full range of equine, farm, and ranch insurance coverage.

Why Marshall+Sterling?

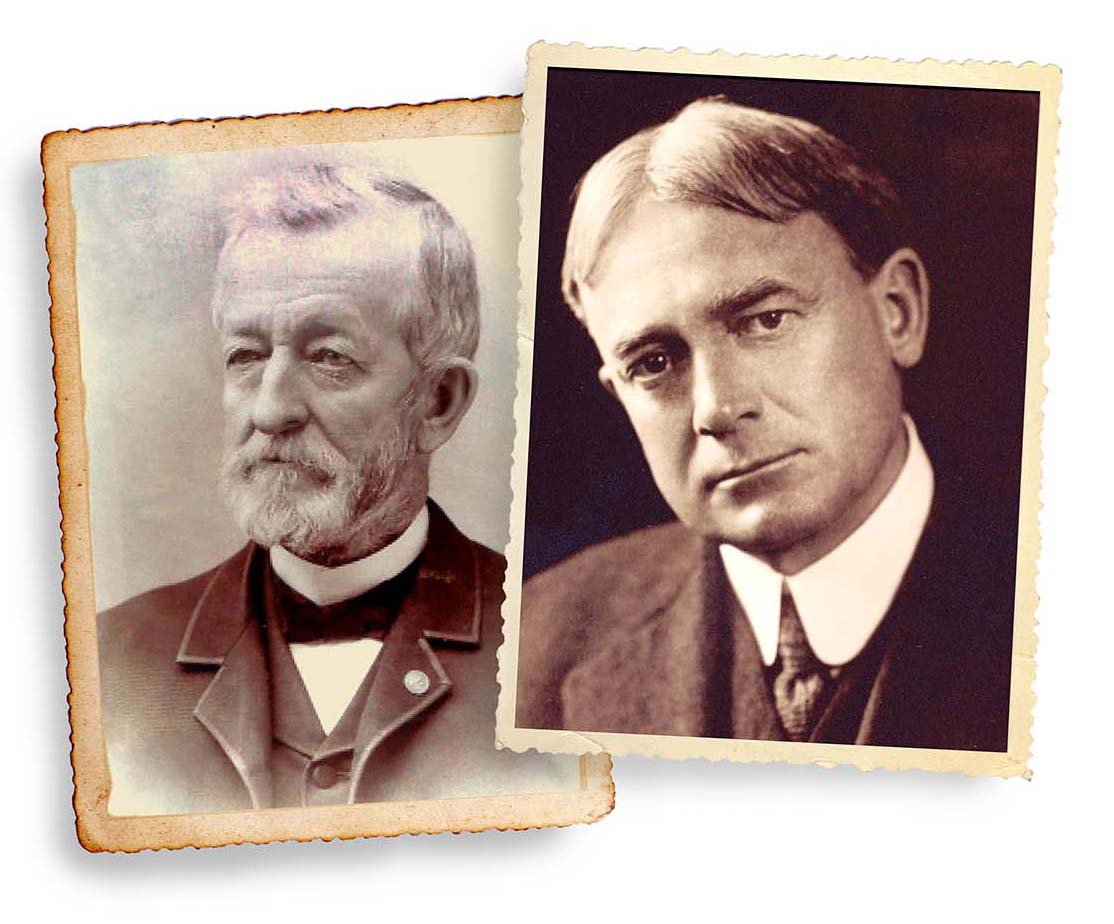

Experience

Marshall+Sterling has 160 years of experience working across a range of industries.

People

You are supported by a dedicated team of risk protection and claims experts.

Process

Our customer-focused planning is based on your unique needs and risk tolerance.

Tools

We use state of the art analytics and predictive modeling to glean actionable insights.

Culture

Marshall+Sterling is employee-owned, which means we’re invested in your success.

“There is a great team oriented feeling, but at the same time I am given the independence and leeway that makes me feel like the owner of my own business.”

Matt Cronin, Sales Management

Careers

Join our growing team.

We’re creating a culture where creative, motivated, and caring people come together to build something meaningful. Build your career at one of the largest employee-owned independent agencies in the nation.

Explore our latest insights.

-

Marshall+Sterling Named Official Equine Insurance Provider of the United States Eventing Association Through 2027

Marshall+Sterling, a top 50 U.S. insurance brokerage of business and personal risk solutions, is proud to announce that it has been named the Official Equine Insurance Provider of the United States Eventing Association (USEA), a designation that will extend through May 2027. This partnership reinforces Marshall+Sterling’s longstanding commitment to the […]

-

How the One Big Beautiful Bill Act Impacts Employee Benefits

Congress recently passed the “One Big Beautiful Bill Act” (OBBB), a sweeping legislative package aimed at overhauling key aspects of tax, healthcare, and workplace policy. The OBBB incudes significant updates to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) aimed at expanding access, increasing savings flexibility, and modernizing tax-advantaged […]

-

Answers to Your 5 Most Common Horse Insurance Questions

As I make my way through social media, taking the pulse of horse owners and their thoughts on equine insurance, a common post reads something like, “Hey hive mind – I’m thinking about insuring my new horse. Any thoughts?” Responses range from recommendations to warnings, and there is almost always […]

-

PCORI Fees Due by July 31st

Employers who sponsor self-insured coverage—including health reimbursement arrangements (HRAs) and certain flexible spending accounts (FSAs)—are responsible for filing and paying the Patient-Centered Outcomes Research Institute (PCORI) fee by July 31st of the calendar year following the end of the applicable plan year. The fee is paid as an excise […]

-

Health Plans Must Expand Coverage for Breast Cancer Screening for 2026

Effective for plan years beginning after Dec. 30, 2025, group health plans and health insurance issuers must expand their first-dollar coverage for preventive care for women to include additional breast cancer imaging or testing that may be required to complete the initial mammography screening process. In addition, health plans and […]

-

Federal EEO-1 Data Collection Now Open!

The EEO-1 mandatory data collection online filing system is now open for employers to submit 2024 EEO-1 Component 1 reports. What is the window when I can submit my filing? The submission period runs from May 20, 2025, through June 24, 2025. Who Does This Impact? The EEO-1 […]

-

IRS Announces 2026 HSA and HRA Limits

The IRS recently released Rev. Proc. 2025-19, announcing the 2026 calendar year dollar limits for health savings account (“HSA”) contributions, the minimum deductible amounts, and maximum out-of-pocket expenses for high deductible health plans (“HDHPs”) and the excepted benefit health reimbursement account (“EBHRA”) limit. By law, these limits are indexed annually […]

-

Employers Should Start Preparing for 2025 RxDC Reporting

Group health plans and health insurance issuers must submit detailed information on prescription drug and health care spending to the Centers for Medicare & Medicaid Services (CMS) on an annual basis. This reporting is referred to as the “prescription drug data collection” (or “RxDC report”). The next RxDC report is […]

-

Spring Checklist

Punxsutawney Phil decreed 6 more weeks of winter about 5 weeks ago, so if you haven’t already, it’s time to get ready for spring—and here are some tips and resources to help! Horse Health VaccinesTypical annual care vaccines throughout the US include Rabies, Tetanus, WNV (West Nile Virus) and EEE/VEE […]

our Community

Making a difference where we work and live.

Our values drive us and our people inspire us. We are committed to being a strong regional partner and playing a key role within the communities we serve.

Marshall+Sterling by the numbers.

#36

largest independent US insurance brokers

100%

employee-owned business

$1B+

in written premiums

200+

insurance carriers

represented

500+

professionals

160

years of service experience

22K

clients served