SECURE YOUR SUCCESS

Getting out in front of risk has its rewards.

Achieving success is one thing. Securing it is another. At Marshall+Sterling, we’re driven to help you reach your business and lifestyle goals—and protect them as the future unfolds.

What We Do

Minimize risk.

Maximize success.

Marshall+Sterling is an independent agency focused on protecting clients with customized business insurance, employee benefits, personal insurance, equine insurance, and wealth management services.

Business Insurance

The world is full of uncertainty. Marshall+Sterling’s business insurance and risk management experts customize plans to help safeguard your business.

Employee Health and Benefits

Marshall+Sterling’s employee benefits experts design and implement compliant benefits programs to fit your business’s needs, culture, and strategic plan.

Personal Insurance

Whether for your home, auto, recreational vehicles, or life and health, we have solutions to protect you from whatever life throws your way.

Retirement and Wealth

Dedicated to simplifying the complexities of the financial world and supporting you in achieving and protecting what matters most.

Equine Insurance

Our Equine Division specializes in personalized plans that encompass a full range of equine, farm, and ranch insurance coverage.

Why Marshall+Sterling?

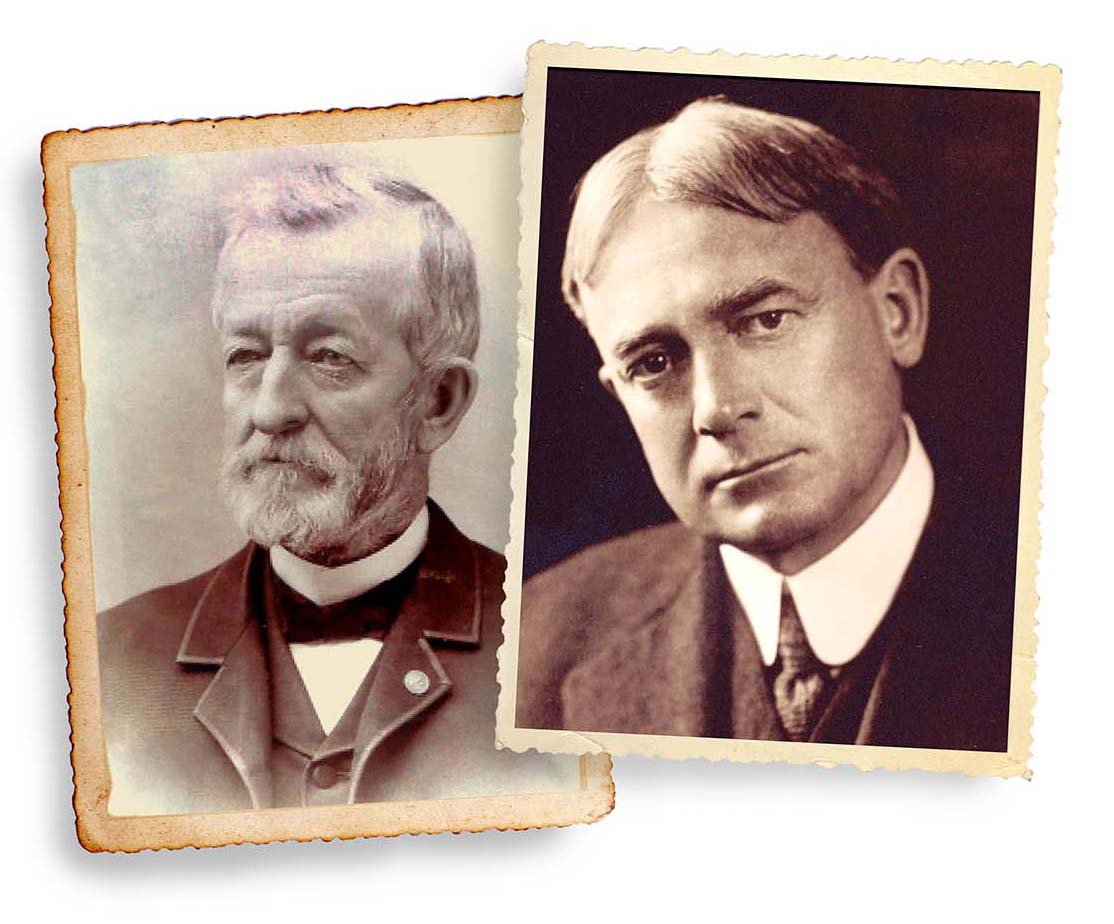

Experience

Marshall+Sterling has 160 years of experience working across a range of industries.

People

You are supported by a dedicated team of risk protection and claims experts.

Process

Our customer-focused planning is based on your unique needs and risk tolerance.

Tools

We use state of the art analytics and predictive modeling to glean actionable insights.

Culture

Marshall+Sterling is employee-owned, which means we’re invested in your success.

“There is a great team oriented feeling, but at the same time I am given the independence and leeway that makes me feel like the owner of my own business.”

Matt Cronin, Sales Management

Careers

Join our growing team.

We’re creating a culture where creative, motivated, and caring people come together to build something meaningful. Build your career at one of the largest employee-owned independent agencies in the nation.

Explore our latest insights.

-

Understanding Captive Insurance: A Strategic Way To Take Control of Risk

Captive insurance allows disciplined companies to align insurance costs with their own loss experience rather than industry averages. Learn how captives work, when they make sense, and why they reward strong risk management.

-

Marshall+Sterling Acquires Sidle Insurance, Expanding Risk Solutions in the Finger Lakes Region

Marshall+Sterling has acquired Sidle Insurance, expanding its presence in the Finger Lakes region and strengthening its ability to deliver integrated risk solutions for businesses, individuals, and families.

-

2026 New Year’s Resolution – Get Horse Insurance!

For many of us, 2025 has been a wild ride — so after taking a collective sigh of relief, let’s get started making a plan to insure your horse for 2026! If the last few years have taught us anything, it is to prepare for the unexpected. That being said, […]

-

Group Health Insurance Costs Are Projected to Rise 8.5% in 2026. Here’s What’s Behind It.

Health insurance costs are expected to rise 8.5% in 2026. Learn what’s driving the increase and how employers can regain predictability and control.

-

Marshall+Sterling Named a ‘Top Employee Benefits Consultant’ for 2025

November 12, 2025 | Poughkeepise, NY – Mployer, the industry-leader in employee benefit research and analytics, has named Marshall+Sterling a winner of its fifth annual “Top Employee Benefits Consultant Awards” for 2025. Mployer’s Top Employee Benefits Consultant Award Program evaluates each benefits broker and consultant office based on their depth […]

-

Biosimilars For Employers: A Cost-Effective Solution

As specialty drug spending continues to rise, many employers are searching for sustainable ways to manage pharmacy costs without compromising quality of care. One of the most promising solutions emerging today is the use of biosimilars — safe, effective, and more affordable alternatives to expensive biologic drugs. What Are Biosimilars? […]

-

In Memory of Mr. John O’Shea

It is with great sadness that we report the passing of John O’Shea, our Chairman Emeritus of the Board. Mr. O’Shea has been a pivotal figure in Marshall+Sterling’s story and success. His influence, wisdom, and dedication indelibly shaped this organization for over 70 years. His tireless service to his community […]

-

Pinnacle Employee Services and Marshall+Sterling Expand Across New York

Pinnacle enters the Capital Region and Hudson Valley, while Marshall+Sterling expands into Central New York through a strategic investment and service partnership October 16, 2025 | East Syracuse, NY and Poughkeepsie, NY Pinnacle Employee Services (PES), a subsidiary of Pinnacle Holding Company, announced today its expansion into the Capital Region […]

-

2026 FSA Limits and Other Indexed Benefit Amounts

Annually, the Internal Revenue Service and Social Security Administration release cost-of-living adjustments that apply to dollar limitations set forth in certain IRS Code Sections. The Consumer Price Index warranted increases in some benefits figures for 2026—for a full summary and charts of key 2026 figures that are of interest to […]

our Community

Making a difference where we work and live.

Our values drive us and our people inspire us. We are committed to being a strong regional partner and playing a key role within the communities we serve.

Marshall+Sterling by the numbers.

Top 50

privately held U.S. insurance brokerage

100%

employee-owned business

$1B+

in written premiums

200+

insurance carriers

represented

570+

professionals

160+

years of service experience