Earlier this month the IRS released Rev. Proc. 2024-25, announcing the 2025 calendar year dollar limits for health savings account (“HSA”) contributions, the minimum deductible amounts, and maximum out-of-pocket expenses for high deductible health plans (“HDHPs”) and the excepted benefit health reimbursement account (“EBHRA”) limit. By law, these limits are indexed annually to adjust for inflation.

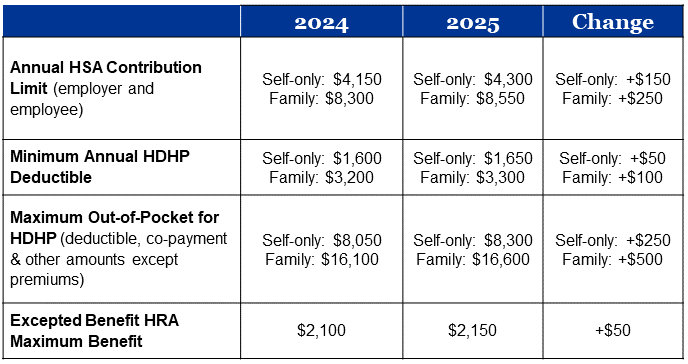

The below table summarizes these adjustments and compares the applicable dollar limits for HSAs, HDHPs, and EBHRAs for 2024 vs. 2025.

2025 HSA and HRA Limits

As always, please do not hesitate to reach out to our Employee Benefits team with any questions or concerns.

Employee Health and Benefits