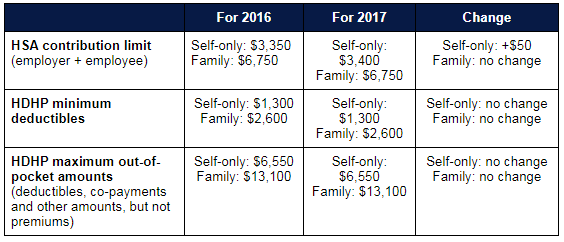

Each year, the IRS adjusts the annual amounts for Health Savings Account (HSA) contributions, high-deductible health plan (HDHP) deductibles, and related out-of-pocket maximums (OOPM).

Aside from a small increase of $50 in the amount that individuals may contribute annually to their HSAs for self-only coverage, 2017 HSA-related amounts remain unchanged from the 2016 limits, as shown in the below chart:

Affordable Care Act Limits Differ

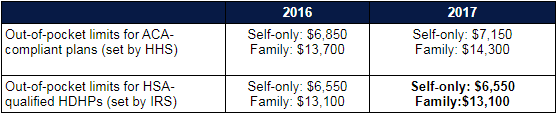

An important thing to note, and a frequent source of confusion, is the existence of two distinct sets of limits on out-of-pocket expenses.

The Affordable Care Act (ACA) imposes out-of-pocket or cost-sharing limits that are slightly higher than the IRS’s out-of-pocket limits on HSA-qualified HDHPs. In order for a health plan to qualify as an HDHP, the plan must comply with the lower out-of-pocket maximum limit for HDHPs.

Employee Health and Benefits

ACA Compliance