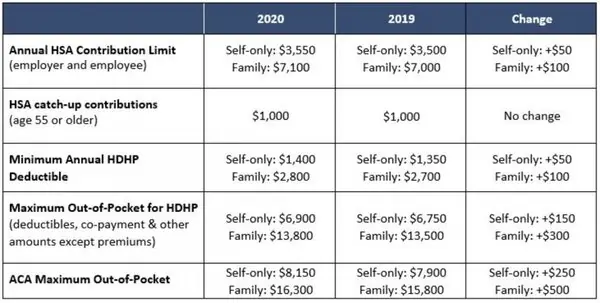

The IRS recently released the inflation adjusted amounts for 2020 relevant to Health Savings Accounts (HSAs) and high deductible health plans (HDHPs) via Revenue Procedure 2019-25. The ACA’s out-of-pocket limits for in-network essential health benefits have also been announced and have increased for 2020.

The table below summarizes these adjustments and other applicable limits.

As shown above, the ACA imposes out-of-pocket or cost-sharing limits that are slightly higher than the IRS’s out-of-pocket limits on HSA-qualified HDHPs. This said, in order for a health plan to qualify as an HDHP, the plan must comply with the lower out-of-pocket maximum limit for HDHPs.

As always, please do not hesitate to reach out with any questions or concerns.

Employee Health and Benefits

ACA Compliance