SECURE YOUR SUCCESS

Getting out in front of risk has its rewards.

Achieving success is one thing. Securing it is another. At Marshall+Sterling, we’re driven to help you reach your business and lifestyle goals—and protect them as the future unfolds.

What We Do

Minimize risk.

Maximize success.

Marshall+Sterling is an independent agency focused on protecting clients with customized business insurance, employee benefits, personal insurance, equine insurance, and wealth management services.

Business Insurance

The world is full of uncertainty. Marshall+Sterling’s business insurance and risk management experts customize plans to help safeguard your business.

Employee Health and Benefits

Marshall+Sterling’s employee benefits experts design and implement compliant benefits programs to fit your business’s needs, culture, and strategic plan.

Personal Insurance

Whether for your home, auto, recreational vehicles, or life and health, we have solutions to protect you from whatever life throws your way.

Retirement and Wealth

Dedicated to simplifying the complexities of the financial world and supporting you in achieving and protecting what matters most.

Equine Insurance

Our Equine Division specializes in personalized plans that encompass a full range of equine, farm, and ranch insurance coverage.

Why Marshall+Sterling?

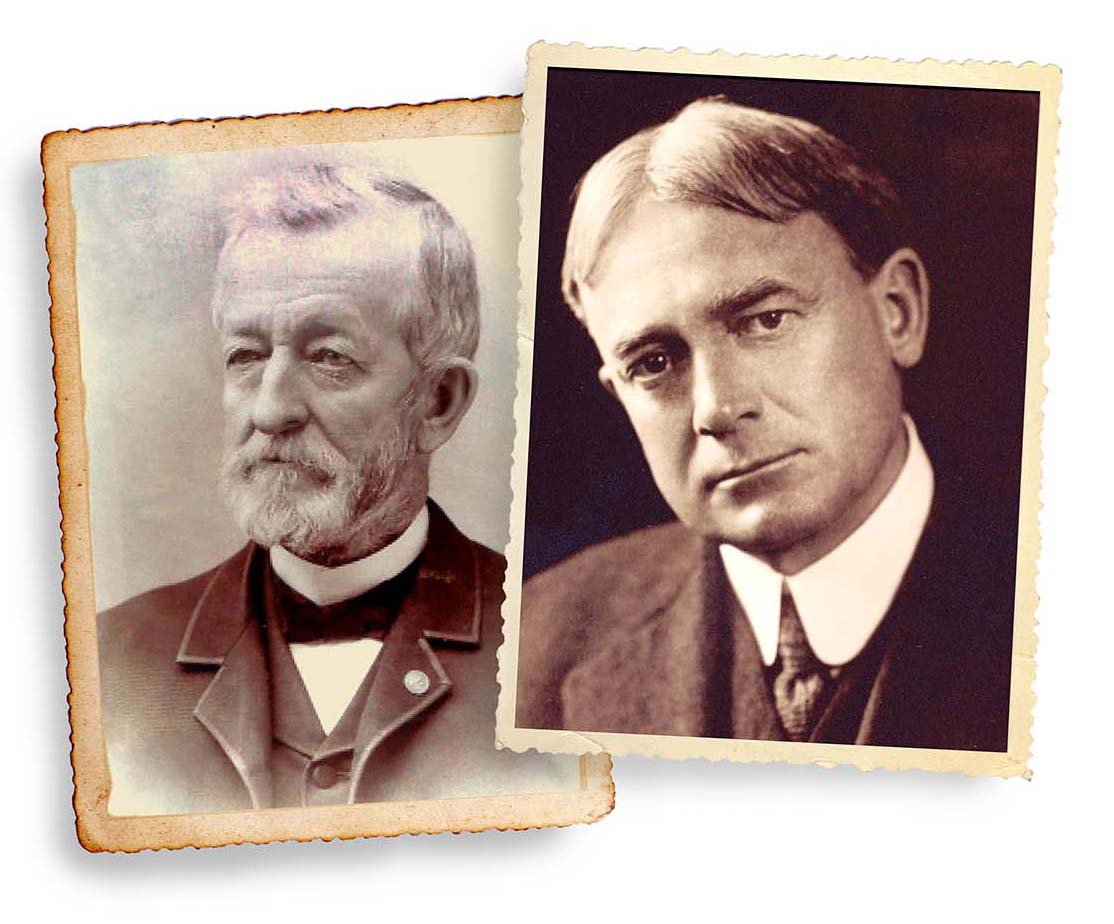

Experience

Marshall+Sterling has 160 years of experience working across a range of industries.

People

You are supported by a dedicated team of risk protection and claims experts.

Process

Our customer-focused planning is based on your unique needs and risk tolerance.

Tools

We use state of the art analytics and predictive modeling to glean actionable insights.

Culture

Marshall+Sterling is employee-owned, which means we’re invested in your success.

“There is a great team oriented feeling, but at the same time I am given the independence and leeway that makes me feel like the owner of my own business.”

Matt Cronin, Sales Management

Careers

Join our growing team.

We’re creating a culture where creative, motivated, and caring people come together to build something meaningful. Build your career at one of the largest employee-owned independent agencies in the nation.

Explore our latest insights.

-

New York Employers Should Prepare for New Labor Laws Starting January 1, 2025

New York employers should begin to prepare for important new labor laws that will take effect on January 1, 2025. Wage and Hour Increases Effective January 1, 2025 New York City, Westchester, and Long Island The general minimum wage rate will increase to $16.50 per hour. Additionally, the minimum salary […]

-

Federal Court Vacates DOL’s Final Overtime Rule Nationwide

On Nov. 15, 2024, the U.S. District Court for the Eastern District of Texas vacated the U.S. Department of Labor’s (DOL) final rule to amend current requirements that employees in white-collar occupations must satisfy to qualify for an overtime exemption under the Fair Labor Standards Act (FLSA). This ruling sets […]

-

2025 FSA Limit Increase and Other Indexed Benefit Figures

Annually, the Internal Revenue Service and Social Security Administration release cost-of-living adjustments that apply to dollar limitations set forth in certain IRS Code Sections. The Consumer Price Index warranted increases in some benefits figures for 2025—for a full summary and charts of key 2025 figures that are of interest to […]

-

Marshall+Sterling Acquires FitzGibbons Agency

Marshall & Sterling Enterprises, Inc., has acquired the assets of FitzGibbons Agency LLC, a third-generation independent insurance agency serving the Oswego and Onondaga communities. The agency was previously owned by Pathfinder Bank and John FitzGibbons. “With this acquisition, we further solidify our strong presence in upstate New York,” said Marshall+Sterling […]

-

Stay Safe After the Storm

If Hurricane Milton is affecting your area, it is important to know the following tips for what to do after a hurricane: Contact your service team promptly to report damages. Be patient, as delays are likely.In addition to insuring your home, we are committed to helping you and your loved ones stay […]

-

The Benefits of Telematics for Commercial Fleets

Managing a fleet and drivers can be a challenge, particularly given the potential for accidents, employee injuries, liability concerns and increased costs associated with vehicle upkeep. Nevertheless, your fleet plays a major role in the success of your organization. As such, it’s crucial to take a proactive approach to fleet […]

-

Protect Your Investment: The Vital Role of Construction Insurance for Glamping Resorts and Campgrounds

As the glamping and outdoor hospitality industry continues to grow, many entrepreneurs are recognizing the potential of creating high-end campgrounds, complete with luxurious accommodations, restaurants, and a range of amenities. However, constructing a large glamping resort involves significant investment and risk. Understanding and securing the right insurance coverage during the […]

-

Empower Your Team: How Employee Training Can Prevent Claims and Lawsuits Across Your Campgrounds

In the campground and glamping industry, having well-trained employees is essential for operational success and risk mitigation. A cohesive, knowledgeable staff not only enhances guest experiences but also plays a critical role in maintaining safety and compliance across multiple locations. The Cost of Inadequate Training Consider a tragic story that […]

-

How to Handle Tree Damage at Campgrounds: Essential Strategies for Risk Management

As camping season approaches, campground managers must prepare for the potential hazards that come with nature, including tree damage. With the increase in extreme weather events—such as wind storms that have become more frequent and intense—being proactive about tree management is crucial. At Marshall+Sterling, our mission is to empower our […]

our Community

Making a difference where we work and live.

Our values drive us and our people inspire us. We are committed to being a strong regional partner and playing a key role within the communities we serve.

Marshall+Sterling by the numbers.

#36

largest independent US insurance brokers

100%

employee-owned business

$1B+

in written premiums

200+

insurance carriers

represented

500+

professionals

160

years of service experience

22K

clients served