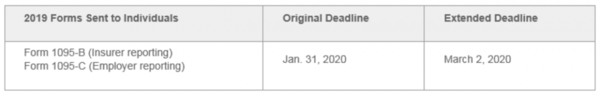

On December 2, 2019, the Internal Revenue Service (IRS) published Notice 2019-63 extending for a fifth time the deadline for furnishing ACA reporting forms to enrollees and employees. The extended deadlines are as follows:

No request or other documentation is required to take advantage of the extended deadline. Despite the extension, the IRS encourages employers and insurers to provide 2019 statements to individuals as soon as they are able.

It is important to note that the IRS has not extended the due date for filing 2019 Forms 1094-B/1095-B or 1094-C/1095-C with the IRS. The IRS filing deadline remains unchanged at February 28, 2020, for those with 250 or fewer forms filing by paper, or March 31, 2020, if filing electronically.

IRS Notice 2019-63 also extends transition relief from penalties related to 2019 ACA reporting if good faith efforts are made to comply with the requirements. In addition, the IRS provided relief from penalties related to failures to furnish 2019 forms to individuals under Section 6055 only, under certain circumstances.

As always, please do not hesitate to reach out to our Group Benefits compliance team with any questions, comments or concerns.

Employee Health and Benefits

ACA Compliance