The IRS recently released 2024 inflation-adjusted amounts for Health Savings Accounts (HSAs) and high deductible health plans (HDHPs) via Revenue Procedure 2023-23.

With inflation still at high levels, this is the second consecutive year of unusually large increases to the HSA contribution limits. The 2024 HSA contribution limits are as follows: $4,150 for self-only coverage ($300 increase); and $8,300 for family coverage ($550 increase).

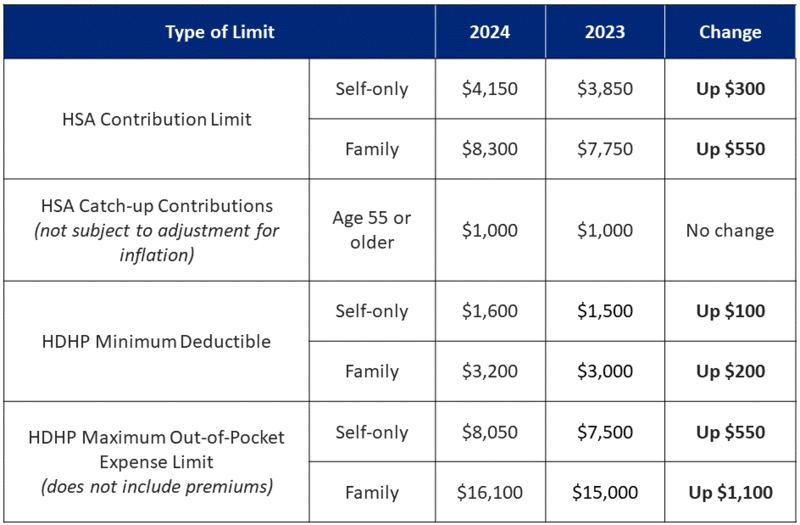

Additionally, the minimum deductible amount and maximum out-of-pocket expense limit for HDHPs have increased. The below table summarizes these adjustments and compares the applicable dollar limits for HSAs and HDHPs for 2023 vs. 2024.

Marshall & Sterling is here to help!

If you have any questions on the above information, please do not hesitate to reach out!

Please note: This update is not intended to be exhaustive, nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Employee Health and Benefits