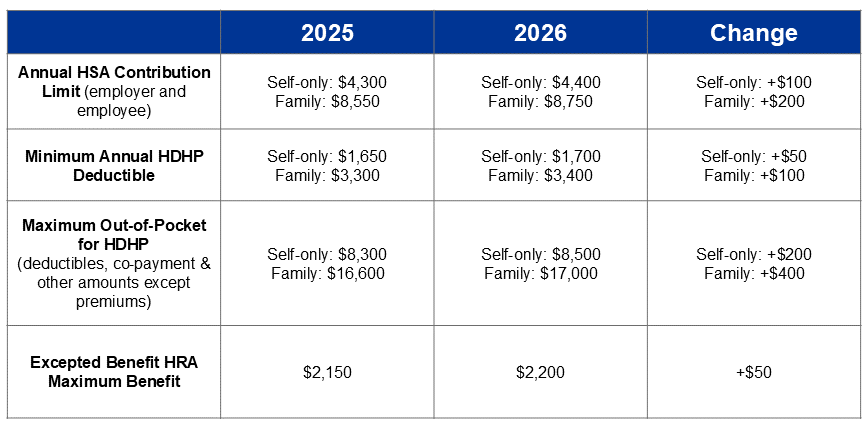

The IRS recently released Rev. Proc. 2025-19, announcing the 2026 calendar year dollar limits for health savings account (“HSA”) contributions, the minimum deductible amounts, and maximum out-of-pocket expenses for high deductible health plans (“HDHPs”) and the excepted benefit health reimbursement account (“EBHRA”) limit. By law, these limits are indexed annually to adjust for inflation.

The below table summarizes these adjustments and compares the applicable dollar limits for HSAs, HDHPs, and EBHRAs for 2025 vs. 2026.

As always, please do not hesitate to reach out to our Employee Benefits team with any questions or concerns.

Please note: This Compliance Bulletin is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice. ©2025 Zywave, Inc. All rights reserved