EQUINE MORTALITY INSURANCE

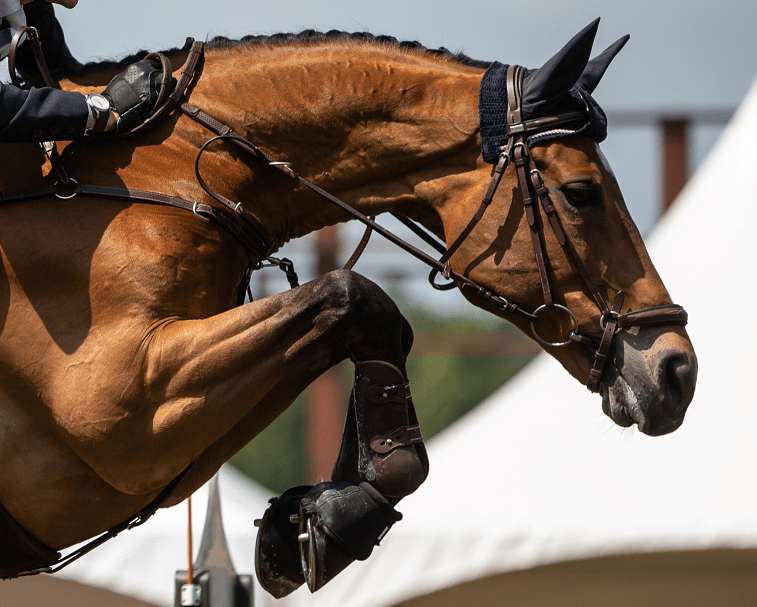

A special breed of coverage.

Horses are a substantial investment that deserve specialized insurance protection. Whether you’re caring for an off-the-track Thoroughbred, a backyard trail companion, a show partner, or an international competitor, we have the people, experience, and plans to give you peace of mind.

What is Equine Mortality Insurance?

Equine Full Mortality, also known as horse life insurance, provides coverage if the insured horse dies during the policy period from a covered accident, illness, injury, disease, theft, humane destruction, or transportation within the continental U.S. and Canada (worldwide options available with approval). Premiums are based on the horse’s age, breed, and use.

Coverages included at no charge by many partner carriers for eligible horses include:

- Emergency Colic Surgery (limit depending on the carrier and the horse’s insured value)

- Agreed Value

- Guaranteed Extension Or Renewal Coverage

Medical and Surgical Endorsements

Major Medical, Veterinary Services, or Medical Assistance (horse insurance endorsements) help reimburse covered veterinary expenses for accidents, lameness, illness, or surgery. Typical limits are: $5,000, $7,500, $10,000, $15,000

Premiums start at $250/year depending on carrier. Deductibles apply, with some plans also including co-pays and/or sub-limits. Coverage is generally available for horses ranging from 30 days old to 18-20 years old.

Even if your horse has a more modest value (under $7,500), is adopted, or gifted, comprehensive medical/surgical coverage is available.

Access our equine mortality applications and forms.

Other Available Coverages

Surgical-Only/ Colic Surgery/ Catastrophic Accident: These endorsements offer focused benefits, a good choice when full medical/surgical isn’t available.

Stallion AS&D (Accident, Sickness & Disease): Infertility coverage for proven breeding stallions who can no longer settle mares in foal.

Air Transport/Overseas Territory Extension: Extends coverage to approved international transport & stays.

The coverages described above are summarized and subject to the terms, conditions and exclusions printed in the policy. Refer to the policy form for specifics on coverages and limits. All coverages are subject to state law, which may vary materially from stated information.

Determining Insured Value

In most cases, horses can be insured for purchase price or less. If value has increased, a Justification of Value form listing competition and/or breeding records, and/or professional training fees paid can be submitted to request higher limits. Homebreds with no performance or breeding record of their own can usually be insured for three times the sire’s stud fee.

Make sure to keep your horse’s bill of sale, proof of payment (such as the cancelled check, receipt, or documentation of a wire transfer), and performance and/or breeding records on file in the event you file a mortality claim, as these will be requested by the insurance company for any claims.

Simple Comparison: Typical Medical/Surgical options

| Endorsement Type | Typical Limits (annual) | Eligibility (general) | Notes |

| Major Medical / Veterinary Services | $5k/$7.5k/ $10k/$15k | 30 days–20 years | Deductibles/co-pays/sub-limits may apply; added to Full Mortality. |

| Surgical-Only / Colic Surgery | $5k/$7.5k/ $10k | 31 days–20 years | Often used when full medical isn’t available. |

| International Transport Extension | Varies by carrier | Prior notice/approval | Extends mortality to approved overseas travel. |

Frequently Asked Questions

Horse life insurance that covers death from covered accident, illness, injury, disease, or theft; standard territory U.S./Canada with options to extend overseas.

Does horse insurance cover colic surgery?

How much do medical/surgical endorsements cost?

Carriers typically offer $5k–$15k limits; premiums commonly start around $200–$250/year depending on limit and underwriting.

Call your carrier immediately (toll-free on your policy) and consult your vet; see our Equine Emergencies page for details.

Visit our Equine Frequently Asked Questions.

Pet Insurance

With our Pet Insurance Program, we can also protect other members of your four-legged family, specifically your dogs and cats.

Protector. Roomie. Fellow Traveler. Best friend. Pets are more than just companions, they’re family. And when unexpected vet bills pop up, the cost of care can be overwhelming. That’s where pet insurance for dogs and cats comes in.

From accidents and illnesses to routine wellness visits, Medical & Surgical coverages can help you manage the cost of vet care so you can focus on what matters most: their health and happiness.

For a pet insurance quote click Here (the link takes you to our dedicated portal with Prudent Pet), or give us a call at (888) 687-8555.

Other solutions from Marshall+Sterling.

Business Insurance

Marshall+Sterling can help you analyze and assess your risk, delivering custom solutions to help you protect your business.

Personal Insurance

Whether for your home, auto, RV, or life and health, we have solutions to protect you from whatever life throws your way.

Employee Health and Benefits

We provide our clients with a wide array of choices for cost-competitive programs throughout the insurance industry.

Retirement and Wealth

Dedicated to simplifying the complexities of the financial world and supporting you in achieving and protecting what matters most.